The Beginner’s Guide to Bookkeeping

Content

In this guide, we’ll explain the functional differences between accounting and bookkeeping, as well as the differences between the roles of bookkeepers and accountants. A bookkeeper does not require any formal training, however a bookkeeper’s job is important. The information a bookkeeper is responsible for gathering and managing affects how an accountant will interpret the financial information of the company.

By having access to this data, businesses of all sizes and ages can make strategic plans and develop realistic objectives. An accounting degree requires deep education and training in tax and other laws with which businesses need to comply, plus finance and business management. While some bookkeepers may have developed similar skills, that level of training isn’t required to be called a bookkeeper.

Tips to choose a bookkeeper for your business

This practice ensures that the accounting equation always remains balanced; that is, the left side value of the equation will always match the right side value. Check out our helpful guide for deciding when is the right time for your business to invest in hiring a bookkeeper. You don’t need any special training to be a bookkeeper—you don’t even need a bachelor’s degree. Bookkeepers offer a literal look at where you stand financially at the moment. Accountants take that financial data and help you see the bigger picture and the path your business is on. If all your mental powers have been focused on getting your business off the ground, you might not yet fully understand what a bookkeeper does.

Accounting refers to the analysis, reporting and summarizing of the data that bookkeepers gather. Accounting reports give a picture of the financial performance of a business, and determine how much tax is owed. But it’s in the 15th century that the roots of modern bookkeeping can be found.

Introduction to bookkeeping

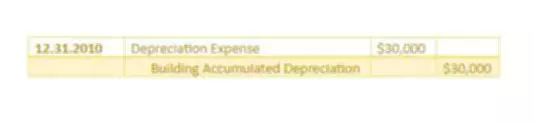

The responsibilities of a bookkeeper include a fair bit of data entry and receipt wrangling. They’re responsible for recording every financial transaction in your general ledger using double-entry bookkeeping—usually called recording journal entries. That sounds like a mouthful, but often that just looks like inputting all your transactions into accounting software. It is the place where a business chronologically records its transactions for the first time. A journal can be either physical (in the form of a book or diary), or digital (stored as spreadsheets, or data in accounting software). It specifies the date of each transaction, the accounts credited or debited, and the amount involved.

Some small companies may not have an official bookkeeper, so an accountant will also take on the responsibilities of a bookkeeper too. Or the bookkeeping duties may be assigned to an accountant with less work experience. Although bookkeepers and accountants have some overlap, accounting is a higher-level and more subjective task. It may take some background research to find a suitable bookkeeper because, unlike accountants, they are not required to hold a professional certification. A strong endorsement from a trusted colleague or years of experience are important factors when hiring a bookkeeper.

Bookkeeper credentials

The skills needed to become a successful bookkeeper are often acquired through working in a career in the finance industry or even by balancing your personal budgets. Many bookkeepers hone and develop their expertise over time while others opt to complete seminars, read books or take online classes. Simply put, business entities rely on accurate and reliable bookkeeping law firm bookkeeping for both internal and external users. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

- By doing so, you can set your business up for success and have an accurate view of how it’s performing.

- For instance, if a small business takes out a $10,000 loan, it will be logged twice under a double-entry system.

- The bookkeeper records supplier invoices in the accounting system, obtains approvals for them, and pays suppliers in accordance with the payment terms stated on each invoice.

- As a partial check that the posting process was done correctly, a working document called an unadjusted trial balance is created.

- An accountant typically has a degree and relevant work experience, however, there is no formal certification process for becoming an accountant.

- It also makes spotting errors easier, because if debits and credits do not match, then something is wrong.

If you find that you have a talent for and enjoy the process, you may consider starting your own bookkeeping business providing this service to others. There’s always a demand for experienced, efficient bookkeepers in nearly every industry. Companies often outsource the organization of their finances to independent professionals, then hire accountants for more complex issues and tax filing.

Other small businesses hire a bookkeeper or employ a small accounting department with data entry clerks reporting to the bookkeeper. Bookkeepers handle the day-to-day tasks of recording financial transactions while accountants provide insight and analysis of that data and generate accounting reports. As your business grows to include more customers, vendors and employees, keeping track of your finances on your own becomes more challenging. When your small business’s bookkeeping and accounting tasks are too much to handle by yourself, it’s time to hire help.