Unearned rent journal entry Example

Content

Perform a monthly check of your balance sheet and the income statement. If you have booked revenue too early you will need to start from scratch and recalculate your earnings for all accounts. Improper revenue recognition will result in an overstated revenue account balance, and understated https://www.bookstime.com/articles/suspense-account deferred income account balance. A credit memo states the customer no longer owes towards the contract. In the same breath, the seller no longer owes services or products. Unearned revenue is any money you’ve collected from clients in advance of providing goods or services.

The advance received becomes the liability to the company till the goods have been delivered or the services have been rendered to the party and will be shown on the liability side of the balance sheet. When you receive unearned revenue, it means you have taken up front or pre-payments before the actual delivery of products or services, making it a liability. However, over time, it converts to an asset as you deliver the product or service.

Criteria for Unearned Revenue

(b) For the securities presented above, describe how the results of the valuation adjustments made in (a) would be reflected in the body of Brooks’ 2017 financial statements. Prior to is unearned revenue a current liability 2017, Brooks invested $22,500,000 in Norton Industries and has not changed its holdings this year. This investment in Norton Industries was valued at $21,500,000 on December 31, 2016.

Generally, unearned revenues are classified as short-term liabilities because the obligation is typically fulfilled within a period of less than a year. However, in some cases, when the delivery of the goods or services may take more than a year, the respective unearned revenue may be recognized as a long-term liability. Since service is owed, it is considered a short-term or long-term liability.

What is the difference between deferred revenue and unearned revenue?

Unearned revenue is most often a short-term liability, meaning that the business enters a delivery agreement with the customer or client and must fulfill its obligations within a year of purchase. Services that will take over a year to deliver upon should be marked as a long-term liability on the balance sheet. Just because you have received deferred revenue in your bank account does not mean your clients will not ask for a refund in the future.

This is because the business has fulfilled its obligation to the customer, and the revenue can be considered earned. You record prepaid revenue as soon as you receive it in your company’s balance sheet but as a liability. Therefore, you will debit the cash entry and credit unearned revenue under current liabilities. After you provide the products or services, you will adjust the journal entry once you recognize the money.

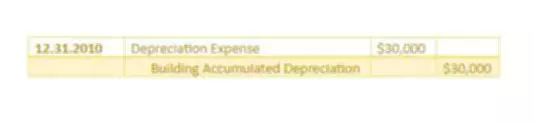

Journal Entries for Unearned Revenue

That being said, unearned rent does not remain a liability forever. When the last month of the lease is over, for example, the unearned rent credit balance is debited, and the rental revenue account is credited, essentially moving it from the balance sheet to the income statement. Some examples of unearned revenue include advance rent payments, annual subscriptions for a software license, and prepaid insurance. The recognition of deferred revenue is quite common for insurance companies and software as a service (SaaS) companies.

What is the meaning of unearned rent?

Unearned rent means rent and prepaid rent paid to a landlord for any period of time beyond the termination of the tenancy. Unearned rent does not include rent due under the lease.

Instead, you will record the payment as a liability on your balance sheet. Unearned revenue is recognized as a current liability on the balance sheet. As the obligation related to the unearned revenue is delivered over time, the liability decreases as the amount is transferred to revenue on the income statement. Under the accrual basis of accounting, revenue should only be recognized when it is earned. Likewise, when the company receives the early cash payment for the rental service, it should record the cash received as unearned rent revenue in the journal entry. Cash is the asset that is recorded upon receipt of funds, and since assets must equal liabilities plus equity, the other side of the journal entry must be a liability account.

Is Unearned Rent an Asset?

As a result, for accounting purposes the revenue is only recognized after the product or service has been delivered, and the payment received. Unearned revenue is a type of liability account in financial reporting because it is an amount a business owes buyers or customers. Therefore, it commonly falls under the current liability category on a business’s balance sheet. It illustrates that though the company has received cash for its services, the earnings are on credit—a prepayment for future delivery of products or services.

Lascia un Commento

Vuoi partecipare alla discussione?Sentitevi liberi di contribuire!